The Supported Living market in the United Kingdom is a fantastic opportunity for investors looking for a safe and appealing return on investment. There is a critical lack of suitable supported living facilities, and both the immediate and long-term need for these facilities is on the rise. International investors can take advantage of a rising market that shows no signs of slowing down, all while improving the lives of vulnerable persons who need ongoing care.

Supported living investments have demonstrated their profitability as a reliable long-term asset class, consistently generating impressive double-digit annual returns. Investors can enjoy attractive rental yields, supported by secure, government-backed leases. These leases are usually held with well-established institutional tenants who are registered with the Financial Conduct Authority (FCA), ensuring an additional layer of security and compliance.

OVERVIEW

| Property tenant: | Yale Housing Association Ltd. |

| Rent issuer: | Department for Work and Pensions, HMRC |

| Location: | Yorkshire, North England |

| Net assured yield: | Year 1: 10% p.a. CPI +1% linked, increasing annually for 25 years |

| Tenure: | Leasehold 125 years or 999 years |

| Payment terms: | Non-refundable initial payment GBP 5,000 per unit |

| Scale: |

1BR apartment 25-48 sqm One price GBP 182,000 per unit. |

| Payment distribution: |

Investors receive payment monthly. Property can be sold any time after 36 months. |

| Investor’s obligations: |

An FRI lease ensures that Yale Housing Association takes full responsibility for the maintenance and upkeep of your asset. All maintenance for white goods, decoration, furniture, the building, and grounds is included at no additional cost. SDLT (5%); Income (20%) CGT & IHT applies, unless buying in a company structure. |

Individuals with significant disabilities or complicated needs can live independently in their own homes or shared accommodations with the help of supported living, a care model that offers individualized support services. By prioritizing empowerment, choice, and inclusion, this approach presents a feasible substitute for conventional institutional care environments. It also represents a substantial government savings.

1. Growing demand: There has been a gradual rise in the demand for supported living accommodation in the UK, driven by a growing recognition of its numerous advantages. The aging population, coupled with shifting societal perspectives on disability and mental health, has resulted in a notable shortage of appropriate housing choices. This has opened up a favorable market for potential investors.

2. Stable and recurring revenue: Investing in supported living facilities frequently entails lengthy lease contracts with governmental entities. This arrangement offers investors a consistent and reliable source of income, rendering it an attractive option for individuals in search of steady and reliable returns.

3. Social impact: Individuals and institutions can generate a positive social impact through investments in supported living by assisting vulnerable adults and fostering inclusion. Achieving financial returns and a sense of purpose are both possible for investors who align their financial objectives with social responsibility.

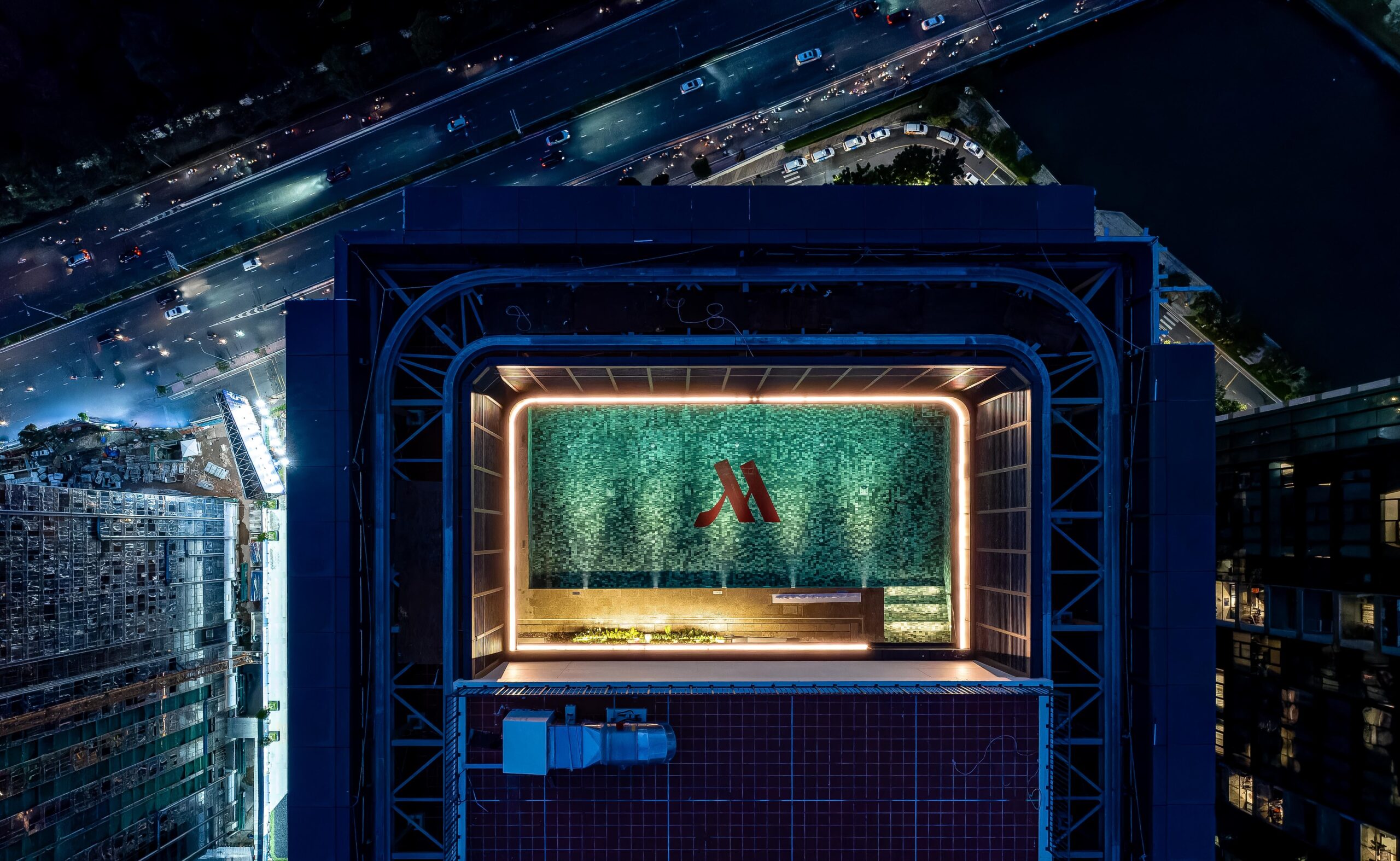

Site

Site  Investor

Investor  Location Yorkshire, United Kingdom

Location Yorkshire, United Kingdom Project scale

Project scale Type of real estate

Type of real estate  Number of Towers

Number of Towers  Number of apartments

Number of apartments  Handover time

Handover time  Pet

Pet  Utilities

Utilities