BUILDING BOOM YET TAXING TIMES FOR VIETNAM

Foreign Investment Booms in Vietnam’s Real Estate—But Policy Challenges Loom

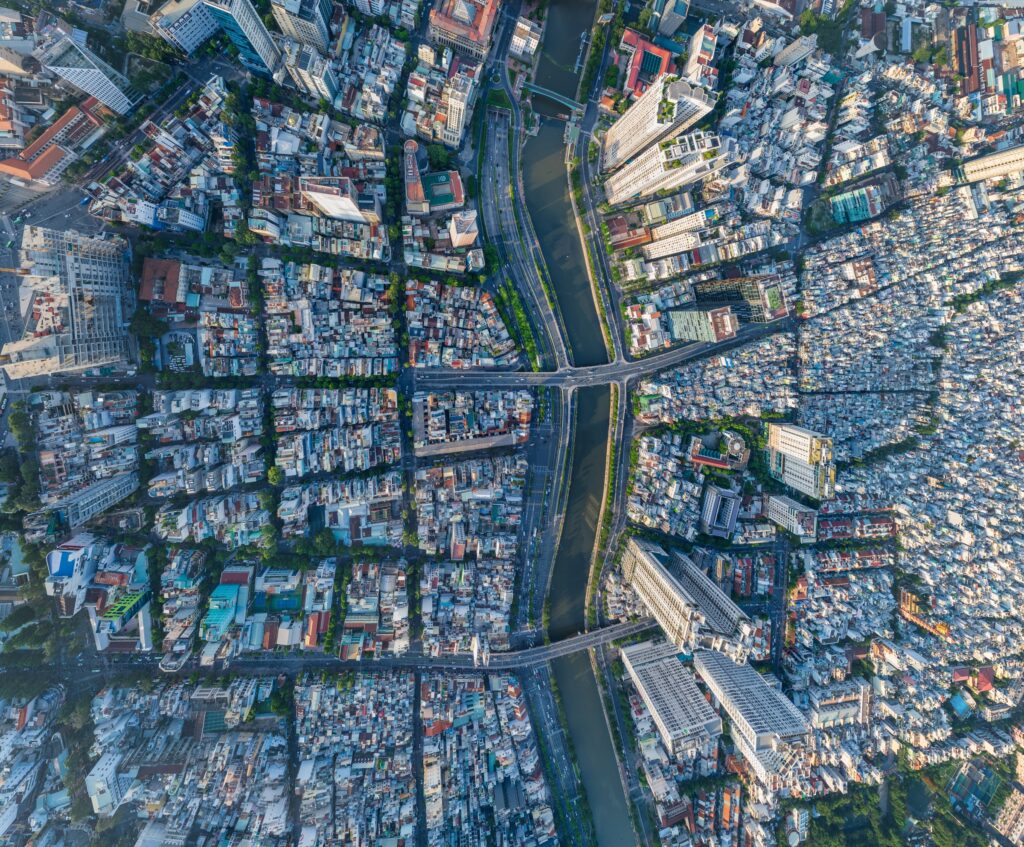

Vietnam’s real estate market is pulling in foreign capital at a breakneck pace. In the first eight months of 2023, foreign direct investment (FDI) into the sector hit $2.4 billion—more than five times what it was a year ago. The surge is impressive, but it raises a question: Is Vietnam’s market ready for this level of investment, or are cracks starting to show beneath the surface?

According to the General Statistics Office, nearly 20% of all foreign inflows this year have gone into real estate. When factoring in adjusted capital, the total jumps to $2.55 billion, marking a 3.7x year-over-year increase. The appeal is clear—Vietnam’s rapid urbanization and expanding industrial base are huge draws for foreign investors. Demand is exploding across residential, commercial, and industrial sectors, and international capital is flooding in to meet it.

But it is not just a story of growth. The wave of foreign interest has sparked debates about whether Vietnam’s market infrastructure can handle it, especially as housing shortages persist and speculative buying drives up prices in major cities. While the capital is flowing, so are concerns about how sustainable this is without stronger policy support.

The Second-Home Tax: Solution or Problem?

Amid this surge, the Ministry of Finance is reviving a long-debated proposal: a tax on second homes and vacant properties. On paper, it’s a response to speculative property hoarding—wealthy investors buying up properties they don’t use, leaving many homes empty while middle-income buyers are priced out. The goal is to free up housing stock and rein in speculative activity that’s inflating real estate prices.

The idea is not new. The concept has been floating around for over a decade but has never gained real traction. Now, however, with urban housing affordability becoming a political hot button, the government is pushing forward. The proposed law is expected to be presented to the National Assembly by late 2024, with possible approval in 2025.

Supporters argue that the tax would curb speculation and make housing more accessible. The policy is straightforward: tax those who own more than one home or leave properties vacant, and redirect the market toward end-users rather than investors looking to park cash in empty assets. In theory, this should bring more housing to the market and help cool off inflated prices.

Investors Aren’t Buying It

But many investors aren’t convinced this is the right move—and they have reason to worry. Critics argue that a second-home tax is a blunt tool that could distort the market. Real estate is not just a key part of Vietnam’s growth story, but also a critical store of wealth. Higher taxes on second homes, they say, will ultimately push costs onto renters and buyers, exacerbating the very affordability problem the tax is supposed to solve.

“Investors don’t absorb new taxes—they pass them on,” says one analyst. “If you add a tax on second homes, those costs will get baked into property prices or rents, making homes even less affordable for middle-income families. It’s not solving the root issue; it’s just shifting the burden.”

The real issue, many argue, isn’t speculative buying but the chronic undersupply of housing in major cities like Ho Chi Minh City and Hanoi. With rapid urbanization, demand is far outstripping the supply of available homes. The government’s focus, they say, should be on increasing supply—through faster approvals, incentivizing affordable housing development, and improving transparency in the market. Slapping a tax on second homes doesn’t fix any of that.

Lessons from Other Markets

Vietnam is not the first country to grapple with housing affordability through taxation. Singapore and Hong Kong have implemented taxes on second homes, with mixed results. In these markets, high property taxes have done little to stop prices from climbing. In fact, they have often just added layers of complexity without addressing the core supply-demand imbalance.

The same could easily happen in Vietnam. A tax on second homes may curb some speculative buying at the margins, but without a meaningful increase in housing supply, it is unlikely to bring prices down. If anything, it may exacerbate the problem by introducing more costs into an already strained market.

There is also a question of execution. Instead of a blanket tax, some argue for a more targeted approach. A higher tax on luxury properties could disincentivize speculative investment at the top end of the market, while leaving mid-tier housing more affordable. Another idea is regional differentiation—higher taxes in overcrowded cities and lower rates in suburban or rural areas to encourage development outside of urban centers.

What Comes Next?

Vietnam’s real estate market stands at a critical juncture. On one hand, foreign investment is pouring in, spurring rapid growth and development. On the other, the government faces growing pressure to rein in speculation and make housing more affordable. The proposed second-home tax aims to address the latter issue, but it could risk destabilizing the former.

In the short term, the tax may slow speculative buying, but without addressing the fundamental supply constraints in major cities, it is unlikely to fix the broader housing crisis. Long-term solutions will need to focus on increasing supply, incentivizing sustainable development, and keeping Vietnam’s real estate market attractive to both investors and end-users.

Get professional insights in Vietnam properties, residential leasing and asset management services by Arcadia Consulting in Vietnam, reach our Residential Services team at rs@arcadia-consult.com.vn.